Get Chase 1099 tax documents online in PDF format

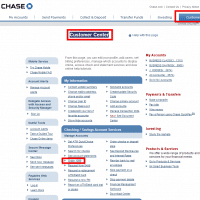

Need to quickly get your 1099-INT from Chase? Don’t worry, it is easy! 🙂 Here are the steps: #1 Login to you Chase account #2 Select the ‘Customer Center’ link at the top of the page #3 Click the ‘Order 1099’ link: #4 Voila, you can now download your 1099 tax documents with the greatest of ease: Summary Easy huh? 🙂 I give Chase 5/5 stars for this very handy feature. This is also a very nice change from other