AT&T mobile insurance vs AT&T mobile protection pack

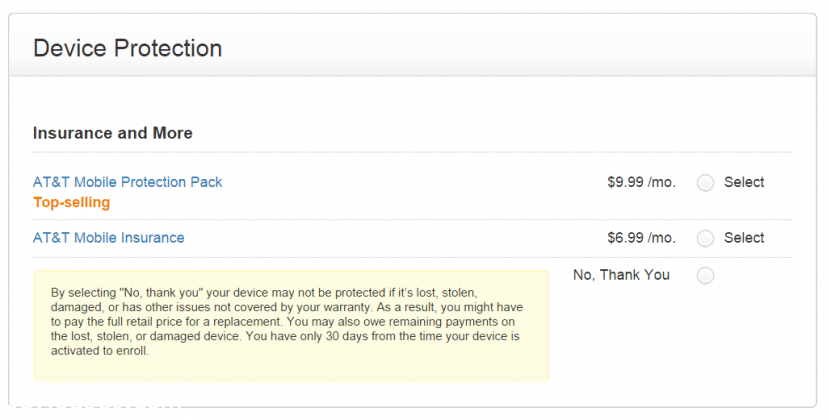

If you are buying a phone from AT&T online, you will likely be prompted to choose one of the following:

My question was: what exactly is the difference between “mobile insurance” and “mobile protection pack”. The answer is, not much.

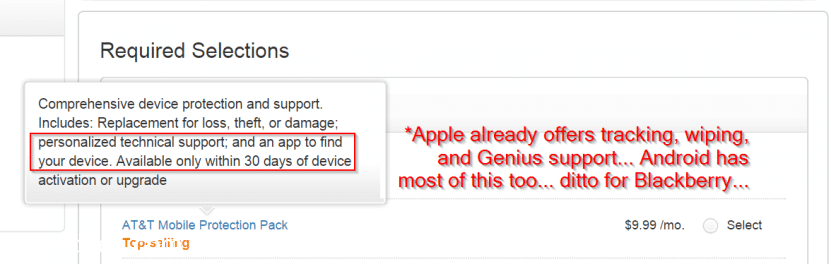

Specifically, the “protection pack” adds: “personalized technical support; and an app to find your device.” The insurance is the exact same that you can get for $3 less if you choose only the insurance. What is surprising is that many phone manufacturers offer these features already!

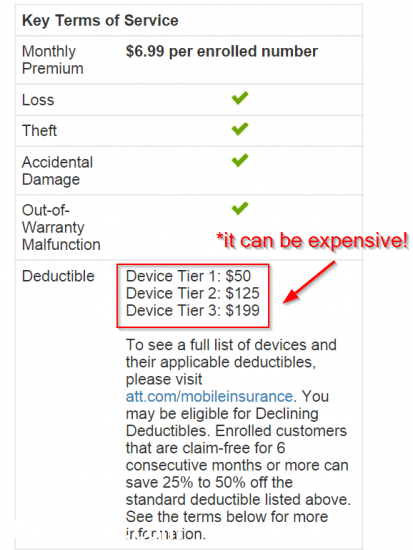

So the insurance is a good idea, right?

Well, maybe. But be aware that there can be a pretty hefty deductible 🙁 If you have an iPhone 6 or a Galaxy S5 you are going to be in Tier 3 and it’s going to be $199 if you have to have your device replaced. You will also be spending $6.99 a month, or $167.76 over the course of a 2-year contract. Add that up and it comes out to $366.76.

Since screen damage is one of the most common issues with smartphones, one might consider just setting aside $100-$200 for screen repair if necessary and skipping the insurance. A nice screen protector and case also helps 🙂

Overall, I would definitely skip the “Mobile Protection Pack” and the Insurance is debatable. I wish a carrier would offer something similar to SquareTrade where you just pay a set amount and you are pretty much covered for repair or reimbursement (though I understand even SquareTrade has issues).

PS here are some more links on the same protection pack topic:

Caution for AT&T’s Mobile Protection Planhttp://mobiliaconsulting.com/caution-for-atts-mobile-protection-plan/It all boils down to this. At&t is making around 2.7 billion dollars a year from this little $3.00 feature, but nobody knows they have it, and you can bet that nobody knows they’re paying for it.

My favorite thing about blowing the whistle on this outrageous scam is that you don’t have to take my word for it, look at your bill, see MPP? I’d bet around 60% of you do.