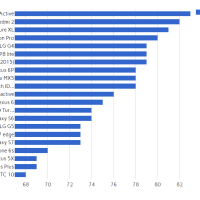

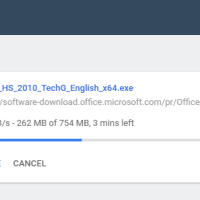

Exede real world download speeds

Real world Exede download speeds: Downloaded 8/20/2016 @ 10:58AM *Bandwidth speed conversion details here. We live off the grid (no power lines, no phone lines) and this download speed compares favorably with DSL in the nearest town (16 miles). Town DSL in the area is generally around 1.2 MB/s or 9.6 Mbps. However, please be aware there are significant drawbacks inherent to satellite internet (latency/lag, affected by weather, relatively high costs, limited monthly bandwidth).