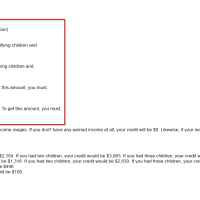

How to maximize my Earned Income Credit [Self Employed]

Here is some very helpful info if you are self employed with (or without) chilren and you want to know the maximum credit you may receive: How Is My Earned Income Credit Calculated? TurboTax can calculate this for you automatically. The amount of your earned income credit depends on: – Your income (both your wages & total income are part of the calculation) – How many qualifying children you have: none, one, two or three. To receive the maximum credit