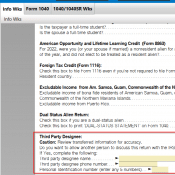

How to add third party designee in TurboTax? [SOLVED, Desktop version]

Question. Can you explain step by step how i add how to add 3rd party designee in Turbotax? Answer. Sure, I can explain how to add a third party designee in TurboTax. A third party designee is a person you authorize to answer questions and provide information regarding federal tax issues on your behalf. You can do that only in the Desktop installed program using Forms Mode. There is no question and answer steps for it. Here are the steps to